2008 Acolid. All rights reserved.

Acolid has followed a number of techniques and methodologies in order to identify its investment opportunities, through adopting a medium investment plan extending over a period of three years with flexibility measures to permit any changes according to the surrounding circumstances. Expenditure and investment annual budgets for projects and subsidiaries are prepared according to and consistent with the investment plan.

The basic foundations of Acolid strategy are as follows:

______________________________________________________________________________________

Objectives:

Establishment of wholly owned projects and/or setting up companies jointly with private or public entities in the fields of livestock development and supportive facilities.

Promoting collective Arab investment programs.

Improving the ways & means of the collective Arab works.

Participating in enriching and expanding sectoral data base.

Increasing productivity, efficiency and competitiveness in the on-going projects

Emphasize integration concepts among Acolid's group.

Investing surplus funds in appropriate growth vehicles.

Ideal utilization of human resources.

Developing the skills, and efficiency in the areas of knowledge enhancement relating to livestock and agricultural fields in the Arab countries.

Transfer and adoption of modern technologies in all productive and supportive activities.

Rendering consulting and technical engineering services and preparing technical and economic studies in the fields of livestock, human resources, and rural development.

Introducing strategic link projects in the industry, and enhancing the integration concepts with all related activities.

Encourage collective Arab works, through proving the feasibilities of investing in livestock & agro-business projects, through acting as a catalyst promoter to strengthen collective economic Arab works.

Supporting the strategy of Arab food security programs

Acolid projects and subsidiary companies continue playing their major role in supporting the strategy of Arab Food Security Programs through increasing the production efficiency and providing the local markets with different consumer commodities, botanical products, and livestock products which contributed positively to bridging the food gap in some hosting countries, in spite of the changing circumstances like drawbacks of selling prices, fierce competition and low-priced imported products. In addition, the productive units faced the increase of production cost. The produced products are not only limited to main consumer commodities such as red meat, chilled processed and frozen chicken, fattened lambs and calves, dairy products, and table eggs, but extended to cover other commodities like honey, fish, agricultural products and vegetables.

Products

|

Quantities

|

Broiler Chicken

|

560 Millions Broilers

|

Processed Chicken

|

475 Thousands Tons

|

Table Eggs

|

3.2 Billions Eggs

|

Dairy Products

|

140 Thousands Tons

|

Fattened Lambs & Calves

|

400 Thousands Heads

|

Processed Red Meat

|

7.5 Thousands Tons

|

Wheat & Barely etc.

|

195 Thousands Tons

|

Accumulative Production of Different Main Commodities

Provision of production input requirements

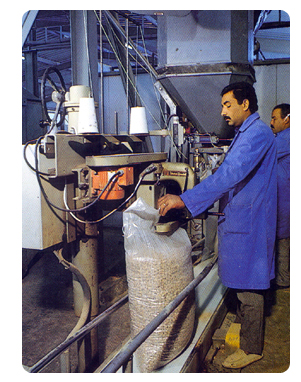

Acolid relied on implementing the principle of production integration strategy between its different projects as well as self-reliance in providing production requisites. It produced parent broiler chicks, hatching eggs, and broiler chicks from the best famous international strains. Moreover, Acolid succeeded in producing concentrated feed, green forage and the production of cattle and poultry equipments.

Item

|

Quantities

|

Parent Broiler Chicks

|

19 Millions Chicks

|

Hatching eggs

|

790 Millions eggs

|

Broiler Chicks

|

650 Millions Broilers

|

Concentrated feed

|

311 Millions tons

|

Green forages

|

946 Thousands tons

|

Accumulative production of some inputs:

______________________________________________________________________________________

____________________________________________________________________________________________________________________________

Risk Management

Acolid is cognizant of the importance of risk management function in conducting its business operations. The policy adopted is to safeguard its liquidity in hosting states who are suffering from soar-inflation, and currency devaluation through using the surplus fund in purchasing additional quantities of raw materials, operation inputs and real-estates like that of Sudan and Syria.

On the same time, part of the liquidity available within the legal and optional reserves was invested in liquid or easy to liquefy assets, including investment in real- estate projects, encouraged by the fact that some governments granted the company various merits and facilities such as free or nominal prices for Lands. Such concept resulted in the commercial and administrative buildings in Fujairah UAE and Sharjah UAE. Parts of these Buildings are used as branches and administrative centers for Acolid personnel to look after marketing, and supervise activities.

Acolid investment in these real estates reached KD ( 12.655 ) millions equivalent to US$(45.68 ) millions representing ( 21.45 % ) of the paid-up capital. Furthermore, part of the available liquidity is invested in money market easy liquid assets of diversified range of products, out of which are diversified portfolios, government bonds and bank deposits. Investment activities are set out and monitored by the investment committee within a conservative frame work approved by the Board of Directors.

Particulars

|

2005

|

2006

|

2007

|

2008

|

2009

|

|

Total Asset

|

$

|

503,406,784

|

518,558,783

|

562,299,643

|

565,540,317

|

598,582,120

|

Shareholders Equity

|

$

|

338,096,653

|

348,997,083

|

375,198,308

|

375,047,108

|

407,059,146

|

Sales

|

$

|

78,685,770

|

94,430,876

|

117,620,225

|

137,268,644

|

147,319,294

|

Profit before Provisions & Reserves

|

$

|

40,455,353

|

20,095,259

|

29,641,914

|

31,923,093

|

36,061,649

|

Return on Capital

|

$

|

16.95

|

9.9

|

14.1

|

15.2

|

17.1

|

Financial Highlight

Investment Field

Acolid is unique in the manner in which it assumes its functions that shows its keenness in allocating and diversifying its investment activities to cover different domains of Animal and Poultry Production, Agricultural Production. Agro Industries, Fish Farming and Breeding, Marketing and Inter-Arab Transactions, Real Estates and Financial Investment sector in addition to rendering consulting technical and economic services and studies.

This diversification in investment fields witnessed the successful policies and awareness to diffuse any passive economic or technical impacts locally or internationally and prompt remedial measures are adopted.

Strategy: